Fine Beautiful Tips About How To Be An Independent Contractor

Choose a business name (and register it, if necessary).

How to be an independent contractor. It's important to have a clean, reliable vehicle. How to become an independent contractor 1. They are in business for themselves, offering their services to the general public.

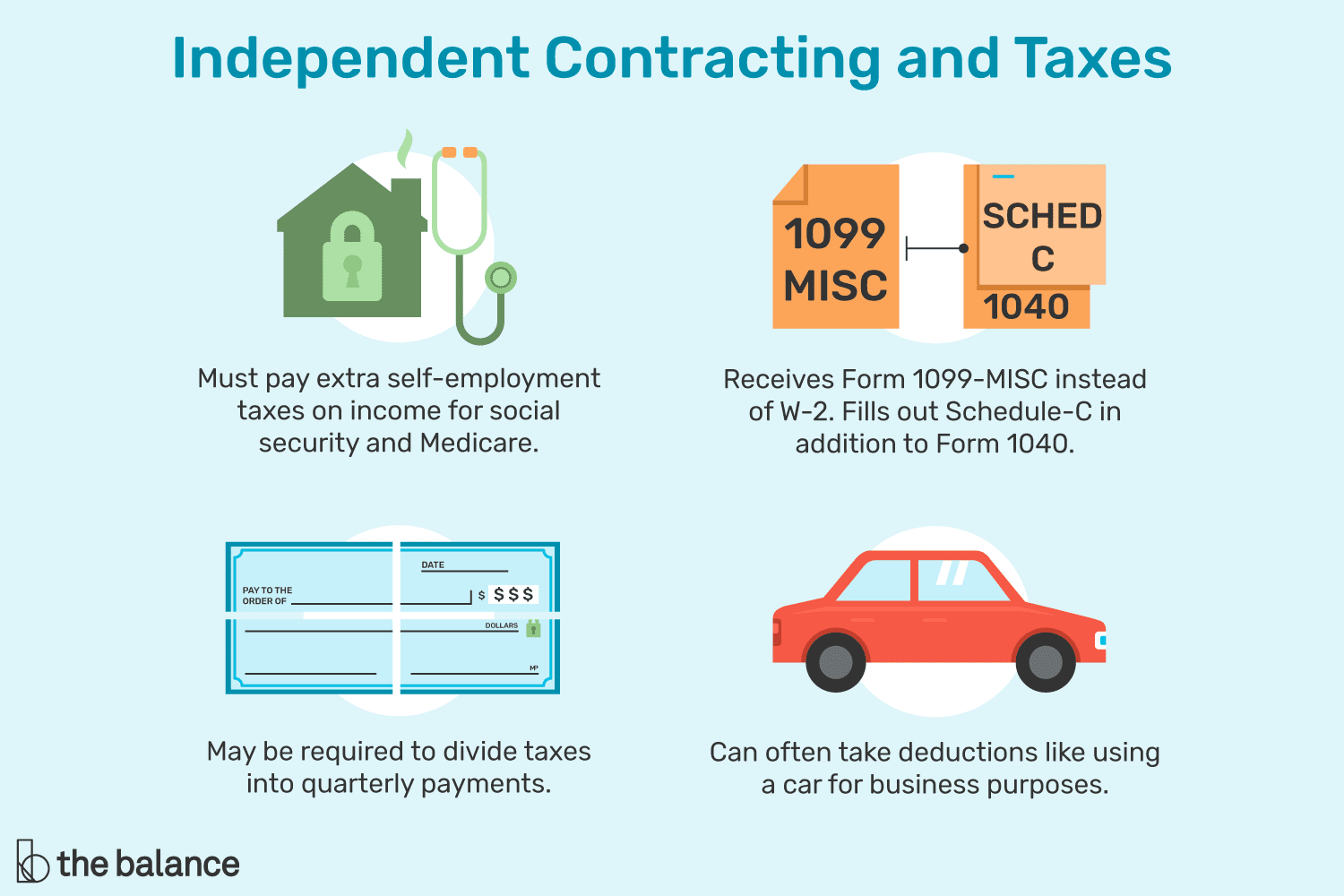

Create a marketable online portfolio. Start by calculating your taxable income after deductions. To determine if this is the case, courts consider several factors including the level of control the.

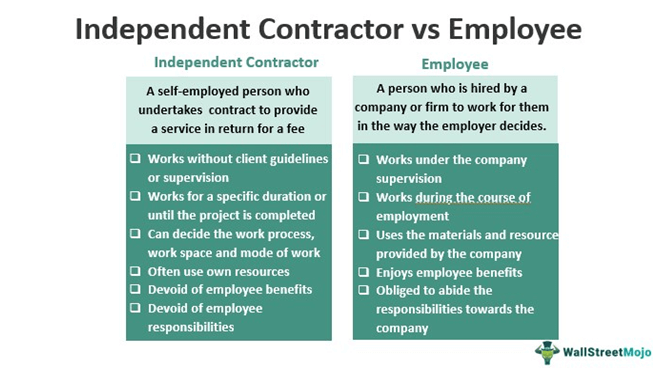

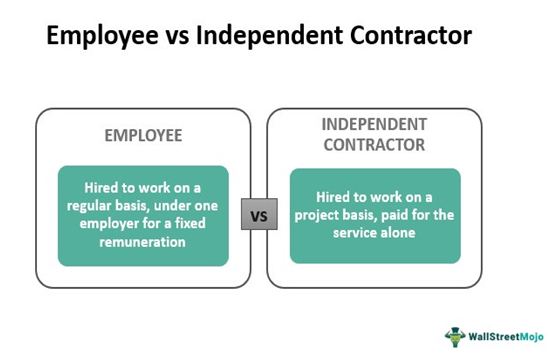

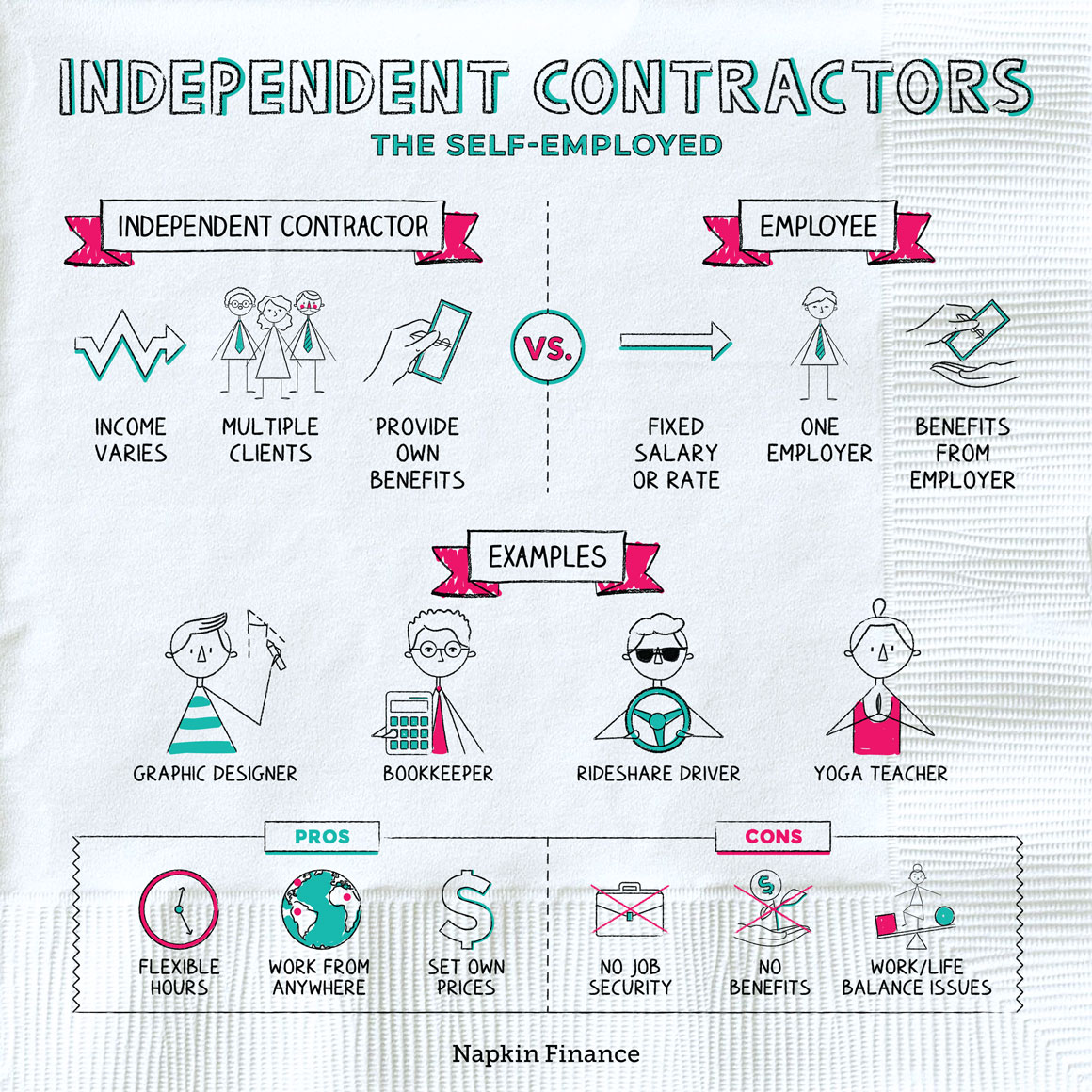

Select a name pick a name that describes what you do and who you do it for. An independent contractor is anyone who does work on a contract basis to complete a particular project or assignment. Engaged in their own independently established business, occupation, trade, or.

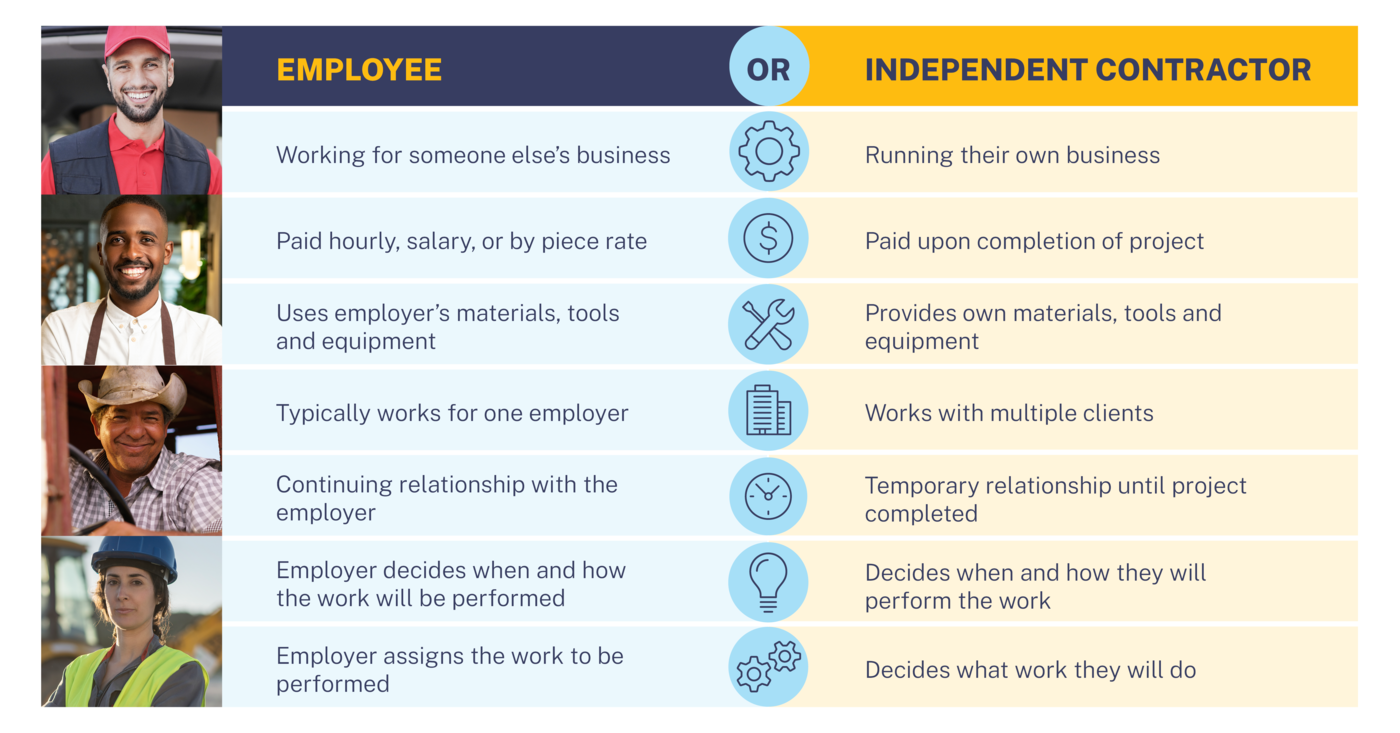

This will be important for marketing. As an independent contractor, you often set your own schedule and decide how many hours you will work. You negotiate and set your salary/pay rate.

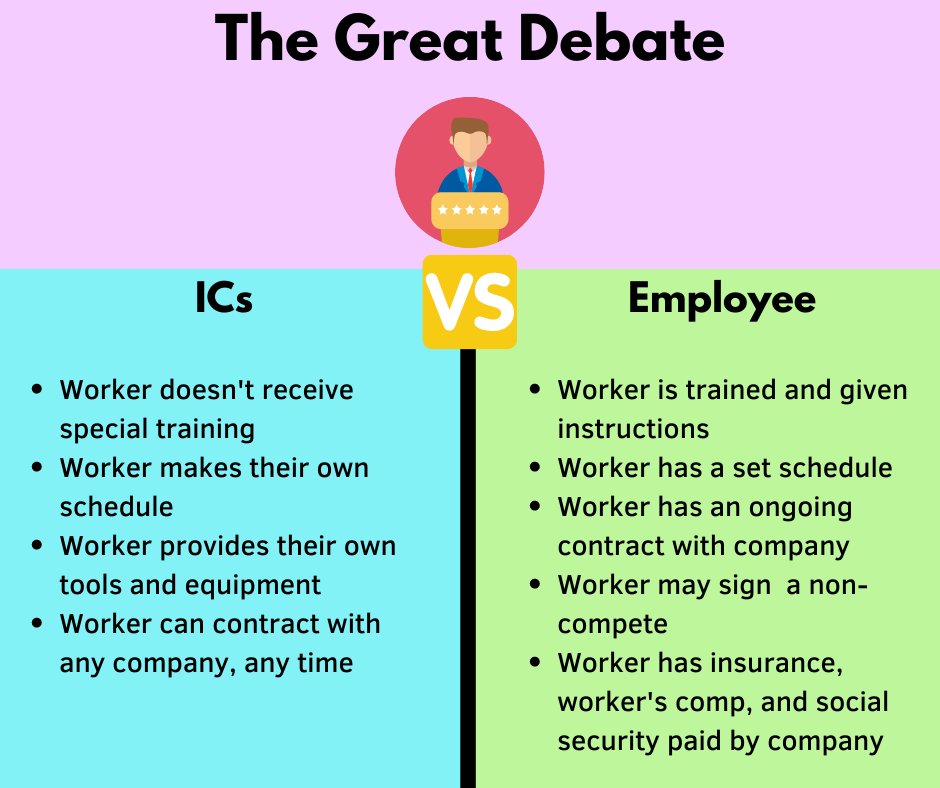

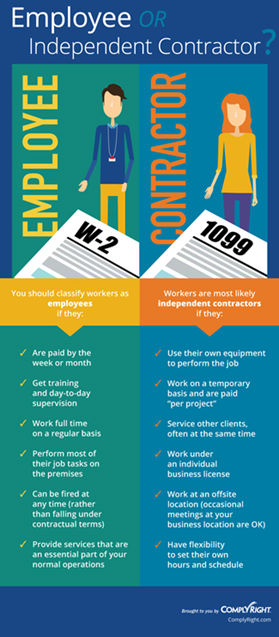

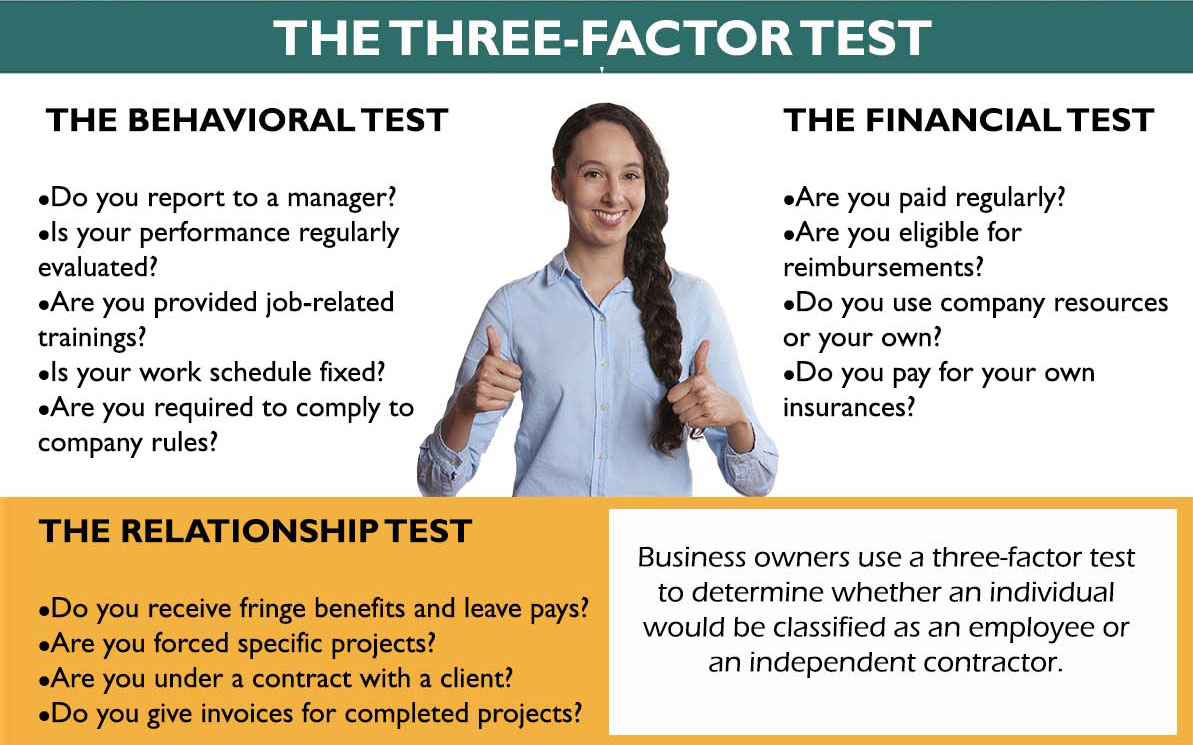

Becoming an independent contractor a worker must be: Being an independent contractor means running your own business, which comes with certain tax benefits like deducting your business expenses. Up to 25% cash back make sure you really qualify as an independent contractor.

In determining whether the person. An associate degree in nursing, called an associate of science in nursing or associate of. You set your own schedule.