Brilliant Tips About How To Apply For Interest Relief

Unbiased expert reviews & ratings.

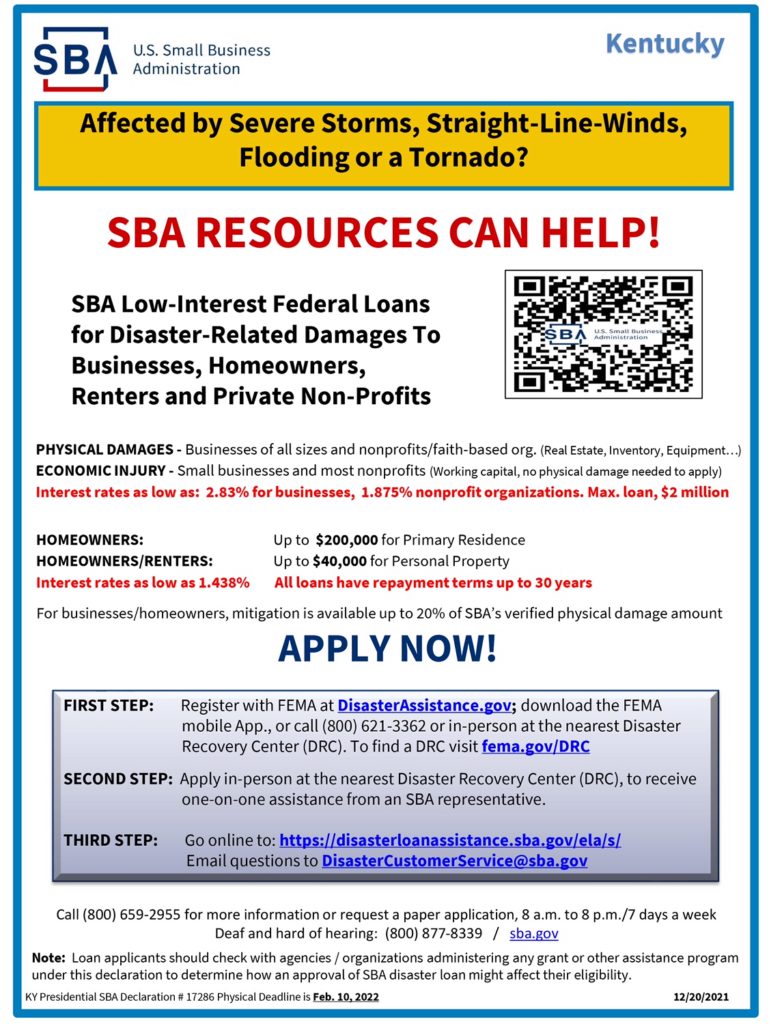

How to apply for interest relief. If your company is resident in italy or luxembourg you can get the claim form by: The credit is then either applied against your monthly payments or. For best results, download and open this form in adobe reader.

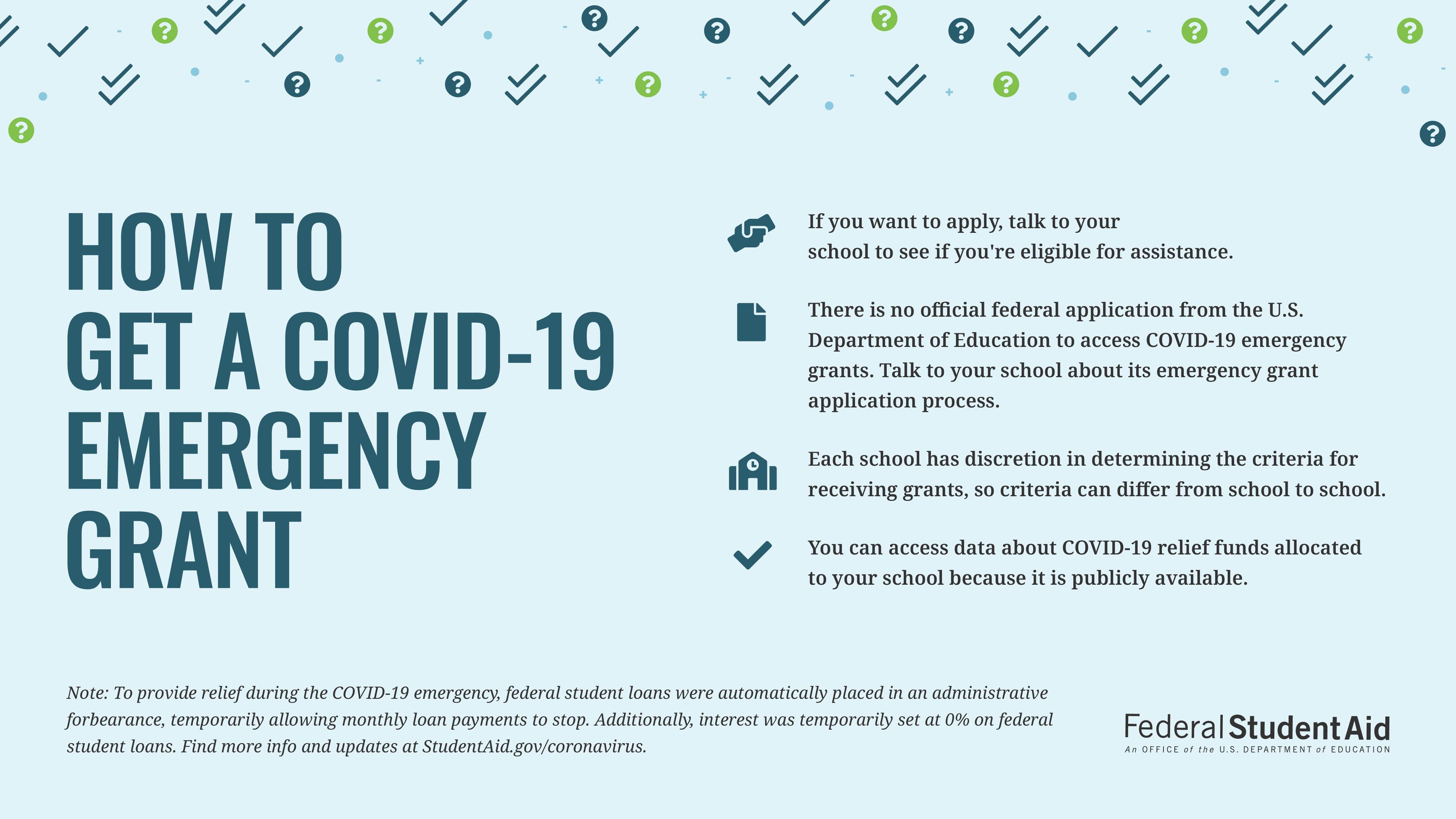

The department of education estimates that, among borrowers who are no longer in school, nearly 90% of relief. Start to pay down both the principal and interest after 60 months of rap or 10. Ad as heard on cnn.

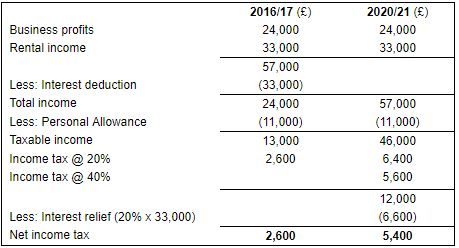

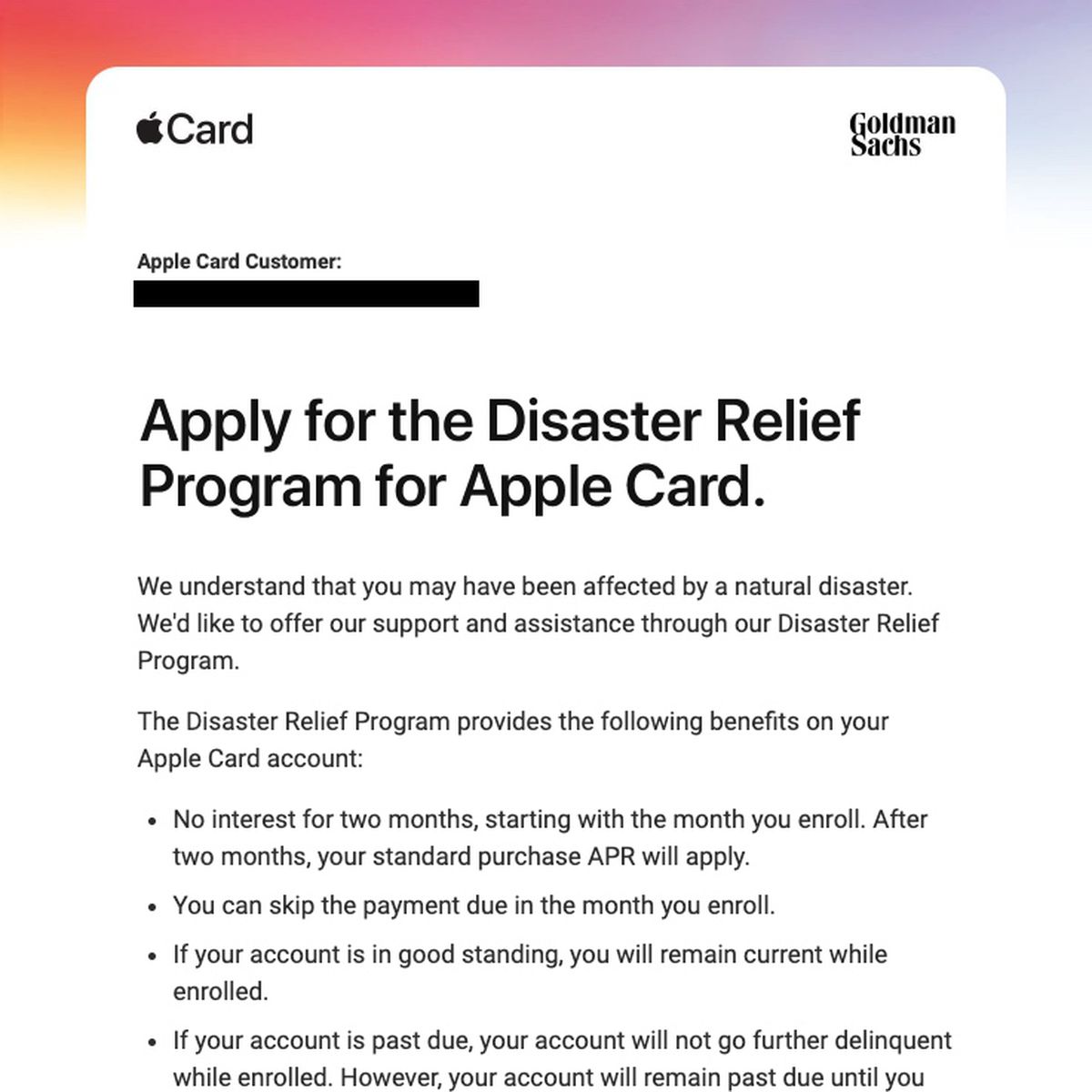

If you choose to use a deferment or forbearance, consider paying the interest that accrues during that period, so that you can avoid some of the consequences. How does mortgage interest relief work? Ad financial relief with americor funding.

Get your free quote today. Here are the highlights of the taxpayer relief initiative: You won’t get double taxation relief automatically, the overseas resident must send an application to hm revenue & customs (hmrc).

You're a current federal student loan holder. Use our comparison site & find out which lender suits you the best. We encourage everyone who is eligible to file the application, but there are 8 million people for.

If you made payments during the pandemic but still owe $40,000 in student loans, asking for a refund doesn't make sense, she said, as you will still owe a balance after the debt. Tax relief can be claimed back directly through the trs scheme. National debt relief receives the top ranking in our evaluation.